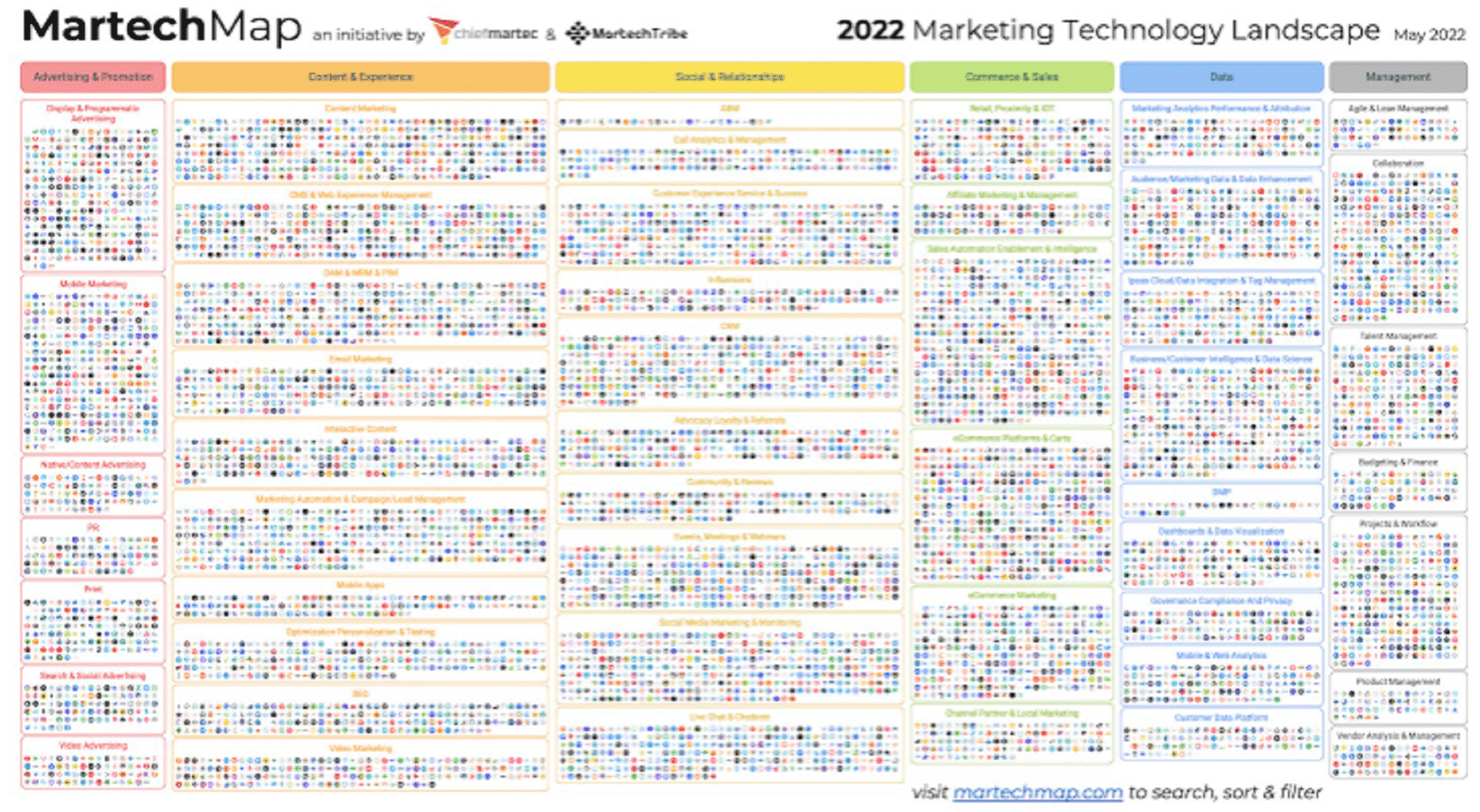

There’s good reason you feel overwhelmed by the marketing technology out there. Actually, there are 9,932 reasons. That’s the number of martech solutions currently available, up from 8000 two years ago, according to the 2022 Marketing Technology Landscape,

Two years after publishing his last marketing technology landscape graphic, HubSpot’s VP platform ecosystem Scott Brinker has partnered with Frans Riemersma of Martech Tribe to create this year’s edition.

What conclusions do the team draw from this?

The space is still growing. COVID-19 had produced initial consternation in the marketing tech community. “Would this crisis be the catalyst for consolidating if not out right collapsing the vast and vibrant martech vendor universe?” write Brinker and Riemersma. The answer, we now know, was that accelerated pressure to digitize businesses would be good news for the martech industry.

They estimate the landscape has grown 24% since the 2020 edition — and a staggering 5,233% since the first edition in 2011. “The drive to deliver better digital customer experiences and streamline digital business operations accelerated the demand for martech and inspired a new wave of startups in the space,” they write.

But there is consolidation. There were almost 1,000 exits from the space in the last two years, representing acquisitions or other business transformations, or simply failures. Many acquisitions were significant, with almost 40 $100-million-plus deals last year. Still, Brinker and Riemersma estimate acquisitions represent only about 2% of the total landscape.

Why we care. While the expansion in the space is entirely real, it is also somewhat illusory. There is no questioning the numbers. Yes, new apps are appearing all the time; yes, that trend is partly fueled by the pandemic-driven acceleration in digital transformation. And, as the authors shrewdly observe, it’s also driven by martech stacks becoming a plethora of specialist apps integrated with one or more consolidated platform. As platforms consolidate, they become willing hosts to app partners (HubSpot has doubled its number of app partners since the pandemic began.)

But there’s no reason to expect the technology market to behave like other traditional markets — not since the cloud came along anyway. Barriers to entry topple for products like SaaS software, which require no manufacture, warehousing or physical distribution. One might imagine a technology company (marketing or otherwise) as a fully staffed operation selling a range of products. Another valid description might be two people with a laptop, an internet connection and an idea. And why not? But it makes one wonder how much of the admittedly long tail of the martech space is made up of those kinds of companies. No wonder it’s a long tail.

Get the daily newsletter digital marketers rely on.

The landscape looks different. The landscape Brinker has been helming since 2011 became a sufficiently iconic visual representation of the space that it’s worth commenting on major design changes evident in the latest versions. The solutions are still grouped into categories (49), but are no longer represented by a tapestry of company logos. Instead, the grid is made up of “favicons” or website icons pulled from company websites.

As for which categories have shown most growth since 2020, content and experience (34%) and commerce and sales (24%) trailed management, which saw a whopping 67% growth. However, is a management tool that can be used equally by marketing, HR or accounting, still martech?