CabinetM has released its Q1 2023 MarTech Innovation Report, a quarterly summary of new technology introductions, feature updates and acquisitions.

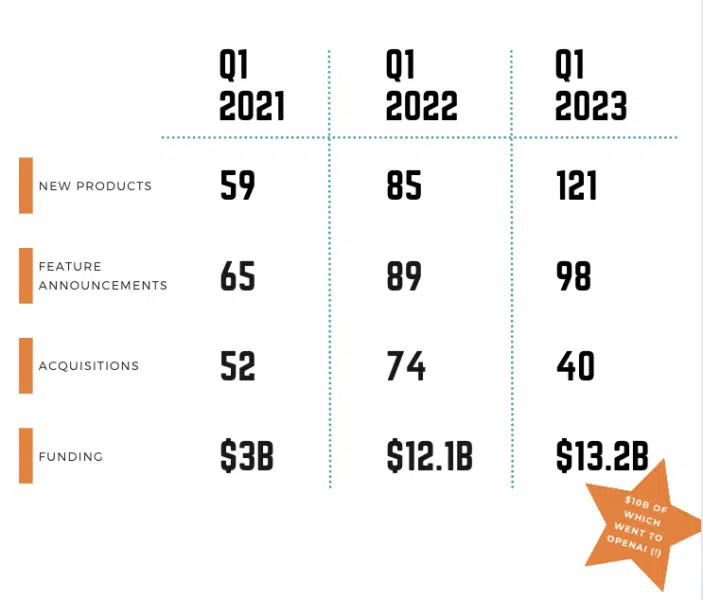

Key findings. Looking at new product announcements, we’re seeing an uptick from previous quarters with the number of new products jumping to 121 in Q1 2023.

Investment in martech companies was spread across 36 categories and increased from $3 billion in Q4 2022 to $13.2 billion in Q1 2023. This number is skewed by a single investment of $10 billion in OpenAI. If you eliminate OpenAI, investment was consistent with Q4 2022 reflective of the continuing innovation and investment in marketing technology.

Dig deeper: Why CMOs must cross the technical divide

The rise of AI. AI has been a widely discussed and utilized technology in martech for quite some time now. It has proven to be a powerful tool for processing massive amounts of data, generating new customer segments, and providing invaluable insights into customer behavior. However, the recent emergence of generative AI tools has sparked a new level of excitement around AI’s potential for martech innovation. These tools are not only easily accessible but also user-friendly, making it simple for marketers to incorporate them into their marketing plans.

Over the past two quarters, CabinetM has begun to track and catalog both generative AI products as well as other categories and products that leverage AI. In Q1, there were 13 new AI tools announced and four vendors that announced new AI capabilities for their existing products.

Categorizing AI is challenging. CabinetM has chosen to approach it as follows:

- Enabled: Products that could not exist without AI.

- Enhanced: Products that leverage AI to deliver new features or better performance.

- Egregious: Products that don’t actually leverage AI but leverage AI claims in their marketing materials.

We give Enabled products their own categories. Enhanced products stay within their core category (e.g. Business Intelligence) but are flagged as leveraging AI to deliver key functionality. Egregious products we do our best to ignore, but it’s often difficult to ascertain what’s real and what isn’t.

Why we care. Categorizing AI offerings in the martech space is something everyone watching it closely is going to need to do. The proposal from CabinetM here is useful (compare it with our own reflections — “Are the AI vendors in the martech space?” — here.

The CabinetM Q1 2023 MarTech Innovation Report is not gated and they tell us that downloading it will not result in a barrage of emails and phone calls.

M&A activity. In Q1 we saw a downturn in M&A activity with 40 acquisitions, in comparison to 74 in Q1 2022, and 52 in Q1 2021. However, in comparison to the Q4 the number of acquisitions is flat. It’s too early to draw any conclusions about whether we are seeing a general downturn; it is something we’ll be watching closely over the coming quarters.

All CabinetM MarTech Innovation Reports can be accessed without a gate on LibraryM.

Get MarTech! Daily. Free. In your inbox.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.